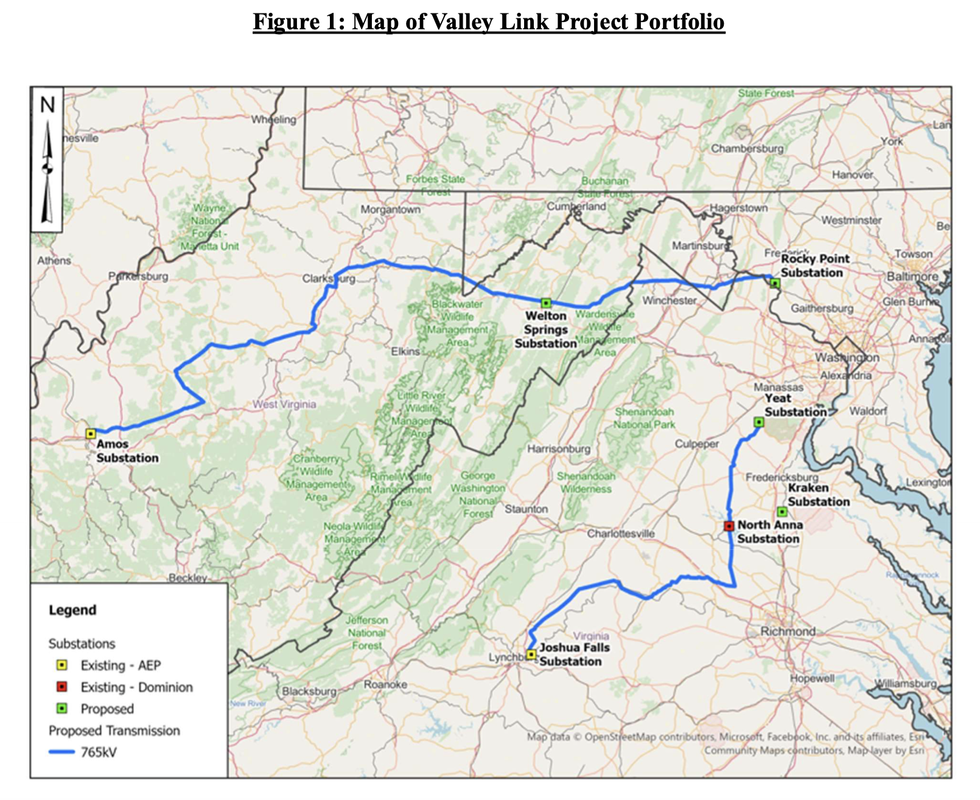

Applying for CPCN/CCNs from the Maryland, Virginia, and West Virginia state commissions is a threshold step for Valley Link during the pre-construction phase, because obtaining CPCN/CCNs will improve Valley Link’s ability to secure the needed land rights to support the Project Portfolio. Because the PJM Board only recently approved the Valley Link Portfolio Project on February 26, 2025, Valley Link has not yet initiated the CPCN/CCN process. Valley Link faces significant time pressure to initiate the CPCN/CCN process within the next few months because CPCN/CCN proceedings in these states can be lengthy.

"Valley Link is committed to collaborating with residents, local governments and other stakeholders in the project communities at every stage of the process."

Well, except this stage. Valley Link doesn't want you to "collaborate" on their request for FERC incentives or in their rate process. All the more reason to do it!

Your first task? Valley Link's 1500 page rate/incentive filing. Go ahead, take a look. I hope you understand FERCish. You don't? Fortunately, I do so here's a summary of the important points included in this filing. You are encouraged to intervene and/or file a comment on this proceeding. Deadline to do so is April 4.

Valley Link's filing asks FERC to grant financial incentives to the project and set up the rate it will use to collect its costs from captive electric customers across the PJM region.

First, let's examine the incentives Valley Link has requested. In order to qualify for incentives, the transmission line must be the product of a fair and open transmission planning process. Competition is an important and required part of this process so that consumer costs may be reduced through competitive cost concessions. Except there were no such concessions for Valley Link. They not only bid their projects in at full price, they also did not include any cost caps. Consumers will pay whatever it costs to build these projects, even though the initial "competitive" bid may have been much lower. The sky's the limit! The idea of competitive transmission is that it allows incumbents and non-incumbents to compete on a level playing field to construct the most cost-effective project. Incumbents hate it because they'd rather not compete at all, and instead be awarded all new transmission in their territory at whatever price they want to charge. For years after FERC's Order 1000 required competitive transmission windows, incumbents simply declined to participate in region-wide competitive planning, preferring instead to concentrate on smaller projects in their own territory. PJM's 2022 Window 3 competitive planning process actually allowed several non-incumbent companies to offer cost caps and financial concessions that actually saved ratepayers money, and those projects were selected, much to the chagrin of the incumbents. But they weren't about to be fooled again, so they created an incumbent cartel and agreed not to compete with each other so that none of them had to make any financial concessions. If they didn't compete with each other, they could create ostensibly "joint" projects that shut out all competitors and took control of PJM's Planning Process. And that's how we got Valley Link's $3B project portfolio, with no limit on how much these projects might eventually cost. Who does that? PJM ought to be ashamed of itself! Valley Link Transmission was not the result of a fair, open and competitive planning process.

Financial incentives for transmission must be rationally tailored to a project's risks and challenges. "Rational" has long ago left the incentives building... it's nothing but a free buffet where utilities gorge themselves on ratepayer cash. That's right, ratepayers fund all these financial "extras" that encourage transmission developers to build "much needed" projects. Except if you attended any of the PJM meetings, you know that these developers are beating each other down to get awarded these projects. And that's precisely because they want to gorge on the unnecessary incentives. Even if FERC stopped offering these incentives tomorrow, these companies would *still* be falling all over themselves to build new projects. Incentives are a give away that is not needed to encourage new transmission.

These are the individual incentives Valley Link has requested, with a brief explanation of each:

- Recovery of 100% of prudently incurred costs in the event that all or part of the Project Portfolio must be abandoned for reasons outside the control of Valley Link (“Abandoned Plant Incentive”)

- Inclusion of 100% of construction work in progress (“CWIP”) in rate base during the development and construction of the Project Portfolio (“CWIP Incentive”)

- Recovery of pre-commercial costs through establishment of a regulatory asset that will include all expenses, including expenses incurred prior to the filing of this application, that are incurred prior to the time costs first flow through to Valley Link customers under the PJM Tariff, including authorization to accrue monthly carrying charges (“Pre-Commercial Incentive”)

- Inclusion of a 50 basis point return on equity (“ROE”) adder for Valley Link’s participation as a new member in a Regional Transmission Organization (“RTO”) (“RTO Participation Adder”).

face significant permitting, siting, construction, procurement, and financial risks that present challenges to developing and constructing the Project Portfolio." So, which is it? Is Valley Link risky or not? It can't be both!

Of course, Valley Link plans to lower its risk that you're going to go all torches and pitchforks on them by "collaborating" with you. Of course, that "collaborating" doesn't mean they will make any adjustments to their plan or anything like that... they just want to pretend they're considering your ideas while they laugh at you behind your back.

Valley Link is committed to collaborating with residents, local governments and other stakeholders in the project communities at every stage of the process. Community engagement is crucial for making informed decisions that reduce or prevent potential impacts while delivering for the public essential infrastructure necessary to address large-scale reliability needs that the PJM grid faces both in the short term and for years to come.

And speaking of interest... Valley Link has requested a base ROE of 10.9%. But they're not stopping there... they are also requesting .5% for their new membership in PJM (see above). Total Return on Equity for this project is proposed at 11.4%. That means Valley Link would earn 11.4% on the unpaid project balance every year for 40 years. Do you earn 11.4% on your investments? Probably not. Transmission ROEs are already incredibly generous.

The important thing to think about with the formula rate is transparency so that we can check the utility's math from time to time to make sure they are doing it correctly. Valley Link's formula rate is not transparent and leaves certain terms undefined. That's probably because of this. However, lack of transparency is not just and reasonable and FERC cannot approve a formula rate that is not just and reasonable.

And I think I'll stop there. If you have any additional questions after reading the filing, I'd be happy to help.

So, let's sum it up:

FERC should not grant transmission incentives to Valley Link because Valley Link was not part of a transparent and competitive transmission planning process.

FERC should not grant the costly transmission abandonment incentive to Valley Link because the project has not been found needed by any state where the public may actually participate in the decision making.

FERC should not grant the CWIP in Ratebase incentive because that starts the money flowing out of ratepayer pockets before any state has approved it.

FERC should not grant the RTO Participation incentive to Valley Link because it is a shell company managed by incumbent utilities that have already been granted this incentive. The "joint venture" is a charade.

FERC must ensure that Valley Link's formula rate is transparent and allows any person to participate in annual updates, seek information, and file challenges.

And keep this in mind when you file your comments at FERC. (File on Docket No. ER25-1633). FERC Chairman Mark Christie had this to say about the cancelled PATH project just over a year ago. (Begin at minute 13:48 and watch for about 5 minutes until he's finished). Attention must be paid! Valley Link is a second attempt to build the PATH project, but it also presents FERC with a second chance to correct all the things Christie said they got wrong with the original project.

RSS Feed

RSS Feed