I've always found it both ironic and fascinating that these IOUs have two faces... one for their regulators and customers, and one for their investors. You often get two completely different stories about the same set of facts. The public story is often about their obligation to serve and their dedication and commitment to providing your electric service at the cheapest possible rate. Regulators get sad, sad stories about how the utility cannot continue to provide service if it isn't permitted to raise rates. And the investors? Well, they get a story that is based on

You can find the utility's public service face just about everywhere, however these IOUs only let their mask slip to reveal the investor face several times a year at what are known as corporate "Earnings Calls."

Earnings calls are an exercise in the absurd. The IOU makes a presentation about its financial situation over the past quarter designed to convince big investment firms to buy more of its stock, and then they take a few questions from the investors. The investors, for their part, know the company is lying to them about how profitable it is, just like they're lying to you about how they are working in your best interest. But the investors are a glib bunch. So friendly with the CEO and other executives on the call! It's just one big, happy, back slapping fest about how much money the company has made, and more importantly, plans to make in the future. The investor's job is to trip the company up with a hard question about their money-making plans. They often ask about stalled projects, or stalled regulatory processes.

Case in point: FirstEnergy's proposal to build a new 800MW gas-fired generation station in West Virginia. First read FirstEnergy's rosy public version, where it's doing this only for the benefit of West Virginians.

Mon Power and Potomac Edison, subsidiaries of FirstEnergy Corp. (NYSE: FE), have submitted an Integrated Resource Plan (IRP) to the Public Service Commission of West Virginia that outlines how the companies will continue to deliver reliable, cost-effective power to West Virginia homes and businesses over the next decade.

West Virginia's energy landscape is changing as industries grow, and the need for dependable, cost-effective power is critical. The IRP lays out a roadmap to meet the need, guided by local priorities and a commitment to keeping power accessible and resilient.

The proposed gas and solar investments are aligned with Governor Morrissey’s 50 by 50 initiative, which aims to boost West Virginia’s energy capacity to 50 gigawatts by 2050. We are pleased to pursue generation projects in a state with strong executive, legislative, and regulatory support.

This is an exciting opportunity for FirstEnergy...

Question: I was just wondering, this morning, on the West Virginia generation, if you kind of talked about build-own-transfer versus self-build, can you maybe kind of talk about how you’d recover the capital in either scenario and how we should kind of think about the impact to earnings 2028 through 2031? If you’re just kind of thinking about a build-own-transfer for 2031, is there really no earnings attribution until then, or could there be milestone payments? Maybe you can kind of expand on that.Answer: The build-own-transfer, I think, is fairly straightforward. On the we build it side, we, of course, would file for CWIP during construction. We’d expect at least the recovery of that, if not the earnings component, during the pendency of construction. The real significant earnings component for that will come after the asset’s online.

... we think of it as firming up the ability for us to be in that 6% to 8% earnings per share range over the planning period. You know, people don’t traditionally think of utilities as growth investments, but as we look at the opportunity to invest in our system, increasing CapEx over the period, it gives us real confidence that we’ll solidly be in that 6% to 8% earnings per share growth range.

Question: You touched on in your comments, I guess, the bill increases and the impact generation has had on that. I was just wondering if you could expand a bit more there on the appetite to build new generation elsewhere across PJM if there’s the proper underpinnings to it. How do conversations look on that, and anything new to report there?

Answer: Yeah. Nothing new to report there, Jeremy. The place where we have a clear window, a supportive Governor, commission, and legislature is in West Virginia. That’s how we’re able to move forward so quickly with those plans. The idea that we’d be building in any of the other states on a long-term basis would really just be speculative at this point.

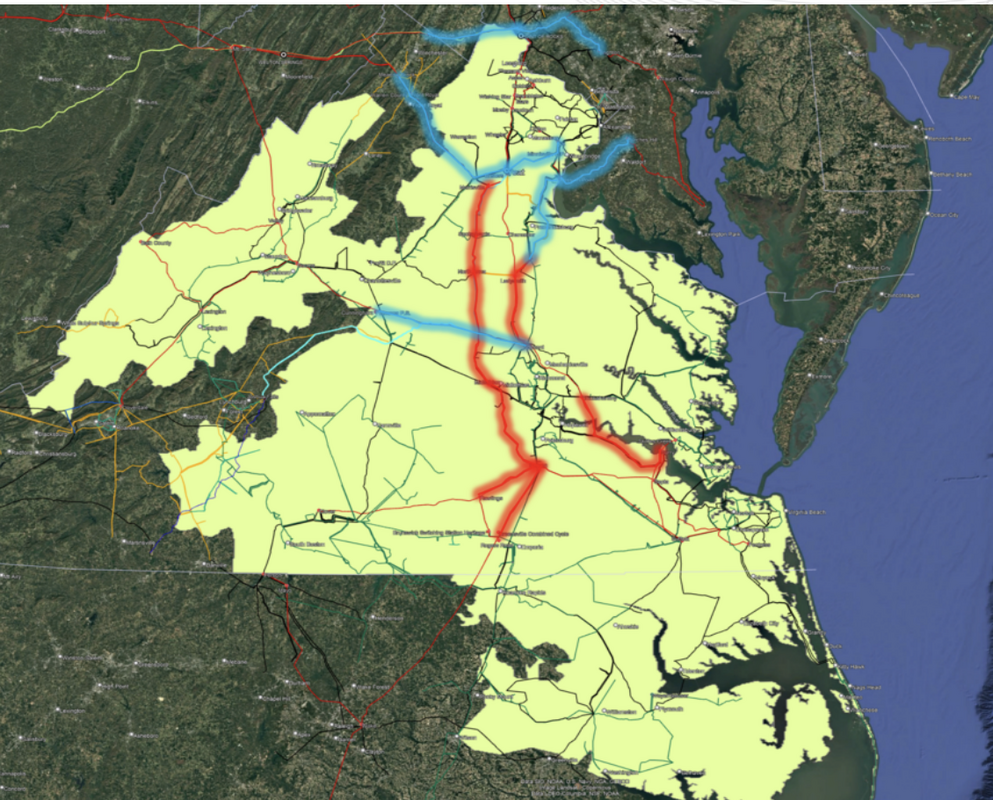

The impact of this demand will be tremendous. Based on data center customers who are contracted or in our pipeline, we expect FirstEnergy’s system peak load to increase 15 gigawatts, or nearly 50% from 33.5 gigawatts this year to 48.5 gigawatts in 2035. Across PJM, peak load projections are forecasted to increase by nearly 48 gigawatts by 2035, or 30% of the current peak load of 162 gigawatts. FirstEnergy is uniquely situated to support this growing demand through customer-focused investments, specifically in our transmission system.

This system is located in the heart of PJM, interconnecting with a broad number of neighboring utilities and encompassing strategic high-voltage corridors that are a vital part of the transmission grid.

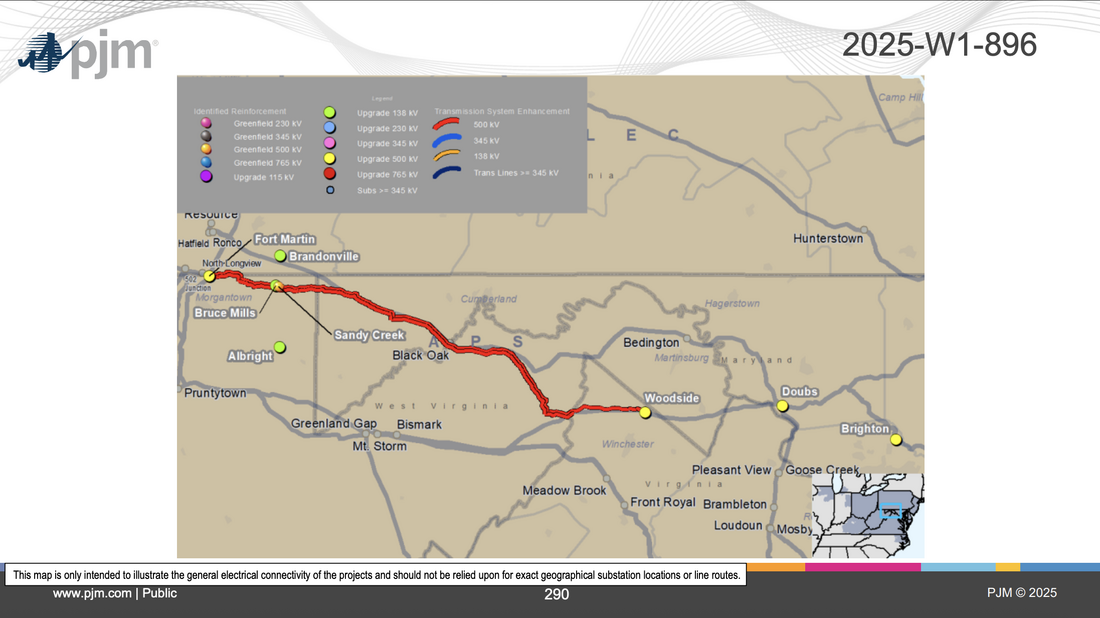

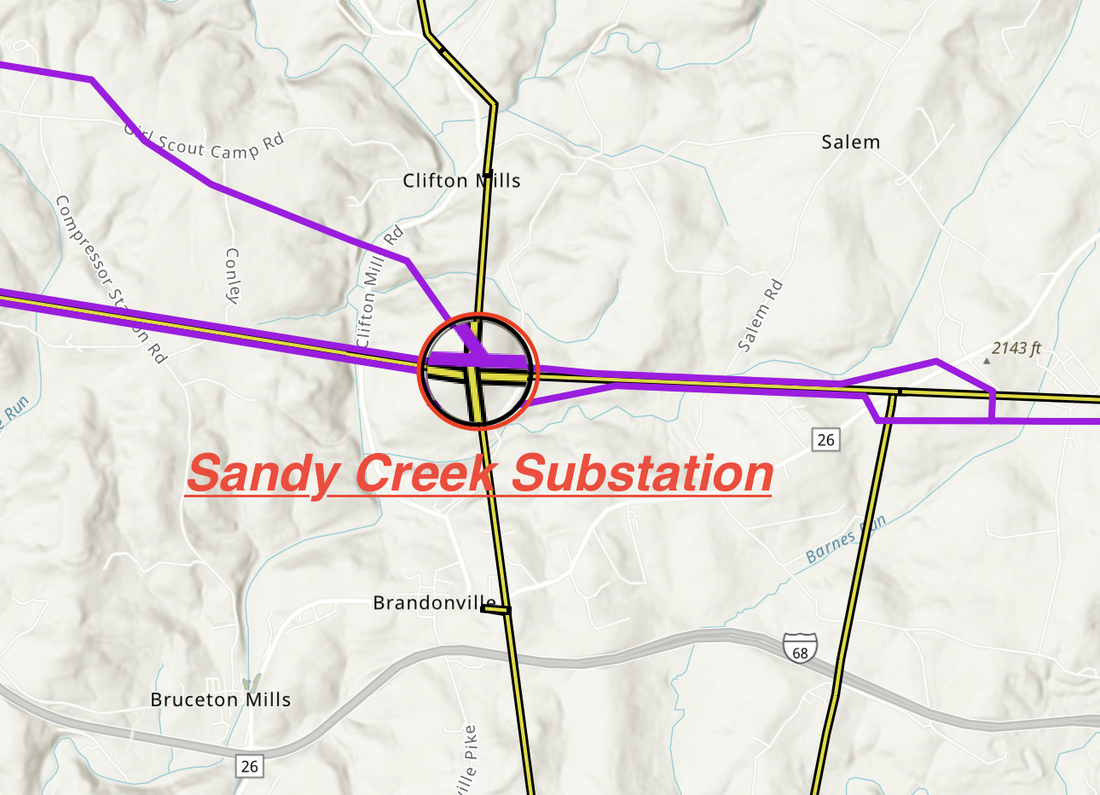

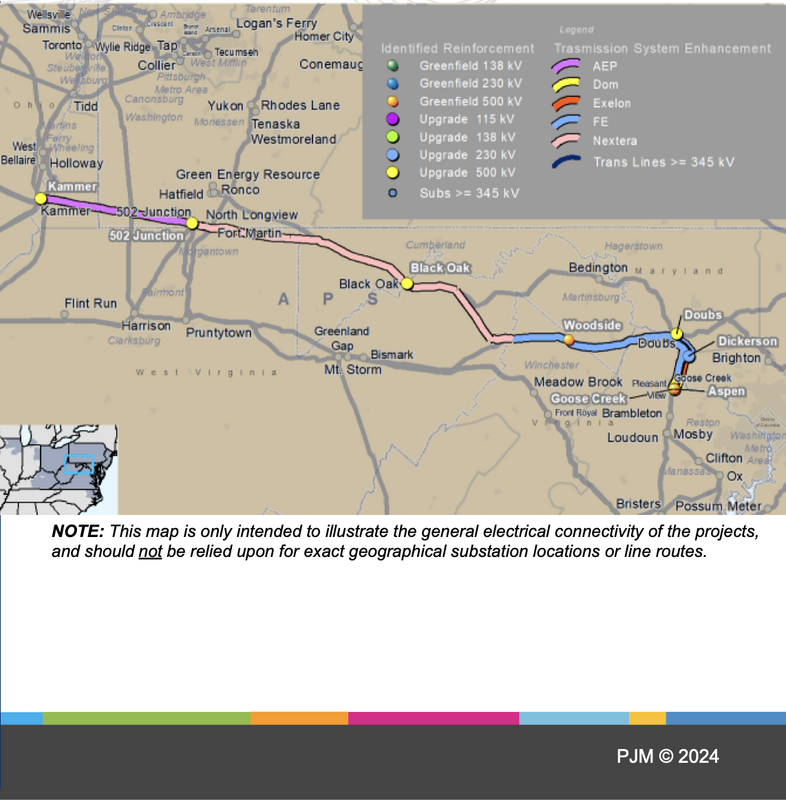

We are also participating in regional network upgrades, which are the investments awarded through PJM’s RTEP open window process.

This includes required system upgrades and improvements to address reliability, security, and load demands of the bulk electric system. Over the last few years, we have been awarded $4 billion of capital investments through the PJM open window process. We recently submitted proposals of capital investments through the 2025 open window to support increasing demand in Ohio, Pennsylvania, and Virginia. These proposed investments include several new and upgraded substations and high voltage lines needed to support the increasing customer demand. The PJM board is expected to award transmission projects in this open window by the first quarter of 2026. Any projects awarded to FirstEnergy in this open window will be included in our new five-year plan. We now expect transmission investments included in the 2026 to 2030 capital plan to increase by 30% versus our current five-year plan.

This includes increases from reliability enhancements and regulatory required investments to improve the overall health and performance of our most critical assets on the system and to address growing demand and changes in generation in the region. Our company-wide transmission assets are a terrific growth engine. Our investments are expected to result in a compound transmission rate-based growth of up to 18% per year through 2030. This means total transmission rate base would more than double through the planning period.

Question: I guess looking at the data center pipeline, I was wondering if you could refresh us on just, you know, the activity seems to continue to be very strong. As you see more gigawatts maybe come in and firm up, is there a way to give any rule of thumb for how much increased transmission CapEx you could see going forward, like on a per-gigawatt basis? I think you’ve given that rule of thumb in the past, but the CapEx that you’re adding to the plan here seems to be, you know, quite a bit stronger. Just wondering your current thoughts on as more and more data center activity continues to come to your service territory, what that could mean going forward.

Answer: In total right now, as we look at what’s contracted and just our transmission CapEx program in total, I think you could say there’s probably easily $1 billion of CapEx associated with transmission interconnection requests, whether that be direct connection projects or network upgrades to support large loads. That’s what we see now based on the contracted and active large load customers that we have. I think that will vary as we move into the future. We’ve seen a wide range of capital deployment based on interconnection requests depending on the location and the size.

Regulators are supposed to balance these two conflicting interests in IOUs (the need to make a profit v. the duty to serve captive customers who have no other choice for service). But watch FirstEnergy during the earnings call talking about how supportive West Virginia's elected officials and PSC is of their plans. These West Virginians are nothing but putty in FirstEnergy's evil, corporate hands.

If you ever have a spare hour that coincides with a FirstEnergy earnings call, you can also listen to it live, instead of just reading a transcript. Way more fun when you can hear their voices and ask yourself if they are telling the complete truth. After all, FirstEnergy got itself into quite a bit of trouble not too long ago pulling some shady stuff. Can its executives be trusted?

Here's a few closing words from FirstEnergy...

Most of this growth will come from high-quality transmission investments backed by forward-looking rates with constructive ROEs. We’re also excited about new opportunities to invest in generation in a state that is supportive of these efforts.

In closing, the team is extremely focused on the value proposition that we offer to shareholders. We are focused on delivering enhanced customer experience through strong customer-focused investments, which in turn will allow us to provide solid risk-adjusted returns to our investors. The future is bright for FirstEnergy.

Whether it be industry-leading transmission investment opportunities, significant reliability investments in the distribution system, or the build-out of regulated generation in a supportive state like West Virginia, we have a strong business plan and the right team to execute. We are committed to continuing our positive momentum and delivering value for our shareholders.

Ask your representatives if they've got your back... or are they going to encourage FirstEnergy to pick your pocket for profits?

RSS Feed

RSS Feed