In 2020, the Missouri Landowners Alliance filed a complaint at the PSC claiming that Invenergy had changed the design and engineering of its project as announced in a press release. The press release claimed Grain Belt Express would increase the capacity of its interconnection in Missouri to 2500 MW. During the evidentiary hearing, counsel asked Invenergy witness Kris Zadlo some questions about its interconnection requests in Missouri. Invenergy's counsel objected to these questions, but the judge initially overruled. The witness gave evasive non-answers to the questions, and his counsel continued to object to any probing into Grain Belt's interconnection in Missouri. Eventually the judge capitulated and shut down this line of questioning. The complaint was eventually dismissed based, in part, on Zadlo's testimony that the project design had not changed and that Invenergy was pursuing the project as permitted. The permitted project contemplated a connection with the MISO system in Missouri at a point in Ralls County. Turns out that was not true at all at the time Zadlo testified.

Invenergy recently re-announced its offering of 2500 MW in Missouri. Grain Belt's ICC application demonstrates that Zadlo was prevaricating. In testimony, Invenergy witness Carlos Rodriguez stated

One 1018 MW interconnection request (queue number GI-083) was submitted to AECI (Associated Electric) in June 2019, with a point of interconnection to the McCredie 345 kV substation.

Four interconnection requests were submitted to MISO in April 2019. The point of interconnection for all four interconnection requests is breaking Ameren’s McCredie – Montgomery 345 kV line, approximately 0.5 miles East of AECI’s McCredie 345 kV

substation. Two of the interconnection requests (total 1,500 MW) are being processed per MISO’s Merchant HVDC Transmission Connection Procedures (“MHCP,” Attachment

GGG) and the two remaining are being processed per MISO’s Generator Interconnection Procedures (“GIP,” Attachment X).

So, what is Invenergy planning now?

The converter in Missouri is proposed to be interconnected with the MISO system along the Ameren 345 kV AC transmission line connecting the McCredie substation and the Montgomery substation. The proposed connection will be made via a single 345 kV circuit from the converter station to a nearby tap point along the Ameren 345 kV transmission line. The proposed converter will also interconnect with the AECI system at the McCredie 345 kV substation. The proposed connection will be made via a single 345 kV circuit from the converter station to AECI’s McCredie 345 kV substation.

Also revealed in the new application is more information regarding Grain Belt's interconnections with SPP, MISO and PJM. Bottom line is that GBE has NO approved interconnections. The SPP one needs to be restudied because of the increased capacity, the MISO ones won't be finalized until sometime next year, and the PJM ones won't be finalized until at least 2025-2026.

Another tidbit Missourians may find interesting... GBE says it will use monopoles in Illinois unless the landowner agrees to lattice, or the lattice structures are needed to support a turn in the line or a long span, such as over a body of water. Missourians were also promised monopoles, but once approved and purchased by Invenergy, GBE announced that all structures will be lattice.

Invenergy also revealed that it has a slightly different plan for use of the line. The public service commissions of Kansas, Missouri and Indiana permitted the project on the condition that no costs would be involuntarily allocated to the state's consumers. Word has it that Invenergy has been pursuing MISO to include GBE in its regional plan and that GBE claimed it was doing that so that it did not have to pay for system upgrades it caused and that they would be involuntarily allocated to all ratepayers in the MISO region. The plan to pay for the project that was permitted relied on federal Negotiated Rate Authority, where GBE negotiated voluntary contracts with customers to pay to use the line. In that scenario, GBE would sell its service to its voluntary customers. However, in its ICC application, GBE now claims it may sell or lease the project to others, instead of, or in addition to, selling service itself.

Subject to additional oversight and approval by the Federal Energy Regulatory Commission (“FERC”), Grain Belt Express may sell and/or lease an undivided interest in the project to potential buyers and/or lessees, and Grain Belt Express and those buyers/lessees may seek to provide transmission service over the line to eligible customers as defined by FERC on a non-discriminatory basis under a FERC-approved open access transmission tariff (“OATT”). Any co-owner or lessee of Grain Belt

Express that seeks to provide transmission service will be required to operate pursuant to an OATT on file with FERC that will meet the requirements of the Federal Power Act and FERC’s regulations. Grain Belt Express may also sell a cotenancy interest or lease a long-term leasehold interest in the transmission line, in which case it is not providing transmission service to such buyer/lessee because the buyer/lessee has control over that undivided interest.

Grain Belt Express has been granted negotiated rate authority from FERC, which

may be updated. Under this authority, Grain Belt Express is required to broadly solicit interest in taking service on the Project from potential customers and accordingly, will offer the opportunity to contract for firm and non-firm transmission service to eligible customers, and to provide transmission service over its available transmission capacity to all eligible customers on a not unduly discriminatory basis. Grain Belt Express will provide eligible customers with the opportunity to contract for transmission service where available transmission capacity exists on the line and cannot and will not unduly discriminate against any transmission customer in favor of another transmission customer. All eligible customers will have equal opportunity to obtain firm and non-firm transmission service through these means. If Grain Belt Express sells or leases one or more undivided interests to potential coowners/lessees, Grain Belt Express may be required to seek FERC approval of such a sale or lease if Grain Belt Express is a public utility subject to FERC jurisdiction at that time pursuant to Section 203 of the Federal Power Act. Furthermore, if any co-owner/lessee seeks to provide transmission service to eligible customers, such co-owner/lessee will be required to comply with FERC’s statutory and regulatory open access requirements and similarly be obligated to provide available

transmission service on its portion of the line on a not unduly discriminatory basis.

Grain Belt Express expects that its co-owners, lessees and transmission customers will consist principally of (i) entities with wind and solar energy ownership interests located in southwestern Kansas and (ii) buyers of electricity—particularly buyers seeking to purchase electricity generated from renewable resources—located in MISO and PJM who take delivery at the respective delivery points. These buyers of electricity are expected to be principally participants in the wholesale markets (utilities, alternative retail electric suppliers (“ARES”), other competitive retail suppliers and brokers and marketers) but could include retail purchasers. The ultimate beneficiaries of the Project will be retail consumers of electricity in Illinois and other parts of PJM, MISO and adjacent markets who purchase and consume electricity from renewable resources that the Project delivers to the MISO and PJM delivery points.

At this time, all of the costs associated with the development, construction and operation of the Project are expected to be recovered through a combination of sales/leases, as well

as FERC jurisdictional services including transmission service agreements with customers and other rates and charges pursuant to FERC approved tariffs and rate schedules. Grain Belt Express does not intend to seek to recover all of the costs of the Project by regional cost allocation to retail

customer load using the transmission cost allocation processes of PJM or MISO.”

The projected cost to construct the total Project and place it into operation is approximately $4.95 billion (not including network upgrades). Grain Belt Express has a viable plan for raising the capital necessary to finance the cost of constructing the Project on a project financing basis. Specifically, after advancing development and permitting activities to a status at which developers of wind and solar generation facilities and other potential customers of the transmission line are willing to enter into commercial agreements for an undivided interest (purchase or lease) or long-term contracts for transmission capacity on the Project, Grain Belt Express will enter into such contracts with interested subscribers that satisfy necessary

creditworthiness requirements. Grain Belt Express will then raise debt capital using the

aforementioned contracts as security for the debt. Grain Belt Express may also raise additional equity capital.

It looks like GBE is just as far away from constructing this project as it has ever been. But yet it continues to tweak the project and condemn private property for a project that still has no customers or signed interconnection agreements. How many more "changes" and additions to this project will the public have to suffer before Invenergy comes up with a workable plan?

When will the PSC stop approving speculative transmission projects and visiting financial pain and uncertainty on the citizens of Missouri?

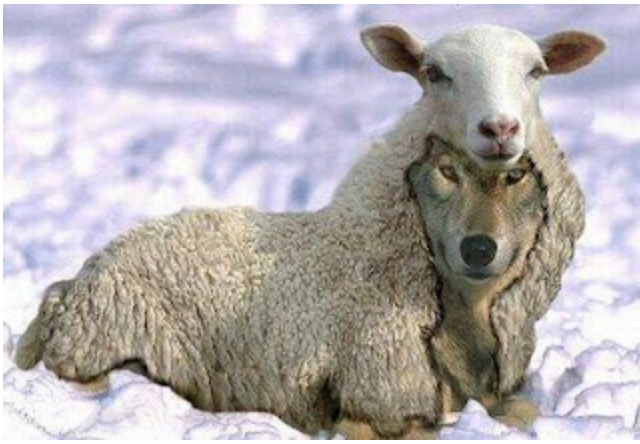

It's about time that Invenergy takes off its sheep costumer and reveals the wolf within, don't you think?

RSS Feed

RSS Feed