Whether certain transmission costs should be directly assigned to a new large-use customer class?

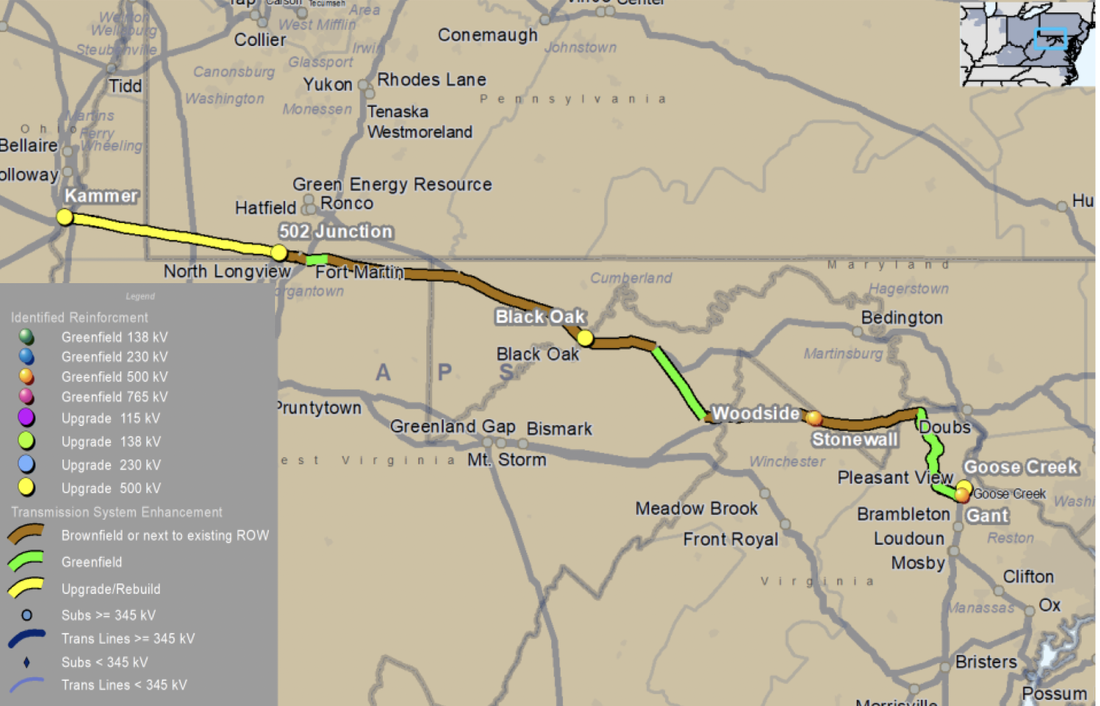

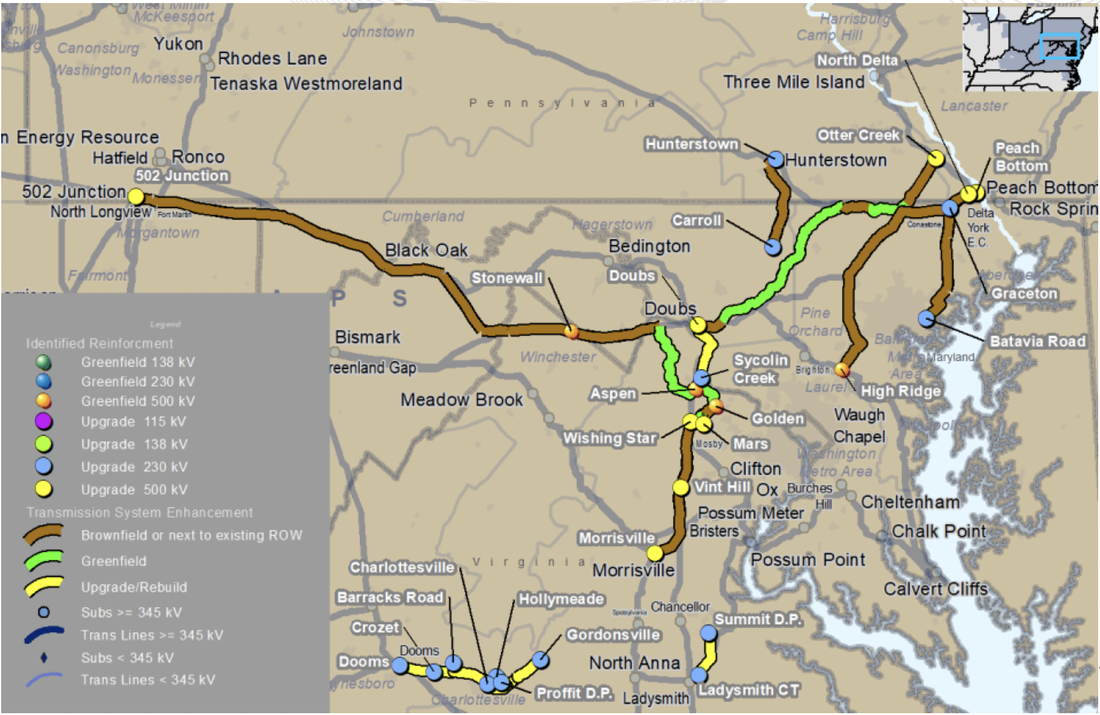

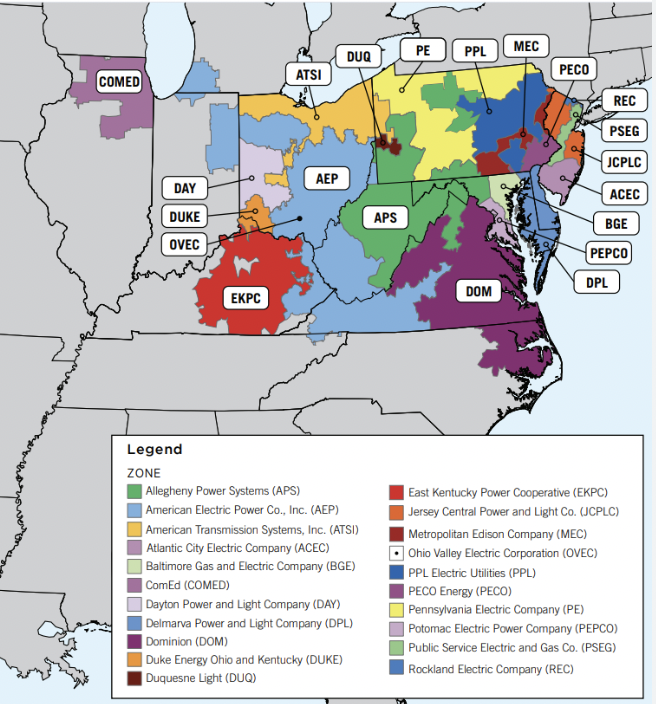

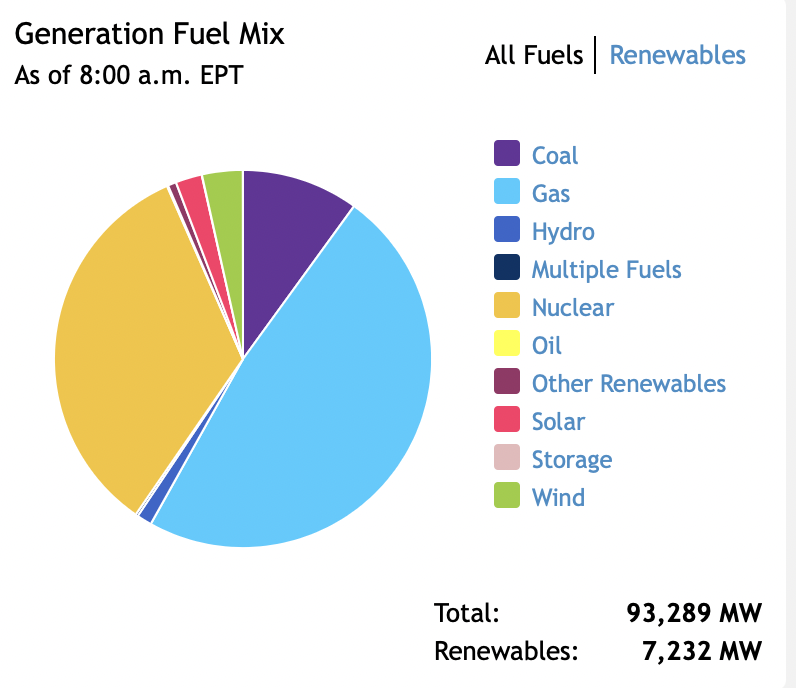

Well, bravo, Virginia! However, Virginia only has jurisdiction to assign the costs that are assigned to Virginia load serving utilities, like Dominion. The cost allocation of these big lines is a federal responsibility under the jurisdiction of the Federal Energy Regulatory Commission (FERC). FERC approves the assignment of costs made by regional grid operator PJM Interconnection. PJM's current approved cost allocation methodology assigns the costs of lines 500kV and above to the entire PJM region. The PJM region includes all or parts of 13 other states: West Virginia, Maryland, Delaware, Pennsylvania, New Jersey, Kentucky, Ohio, Illinois, North Carolina, the District of Columbia, Indiana, Michigan and Tennessee. When PJM orders a new line 500kV or above, it allocates the costs among all 13 states based on the percent of the entire system that state has used over the past year. Every state in the region uses the PJM system, and every one of those states gets a portion of the cost. Each state then assigns the costs to its electric consumers using state rate classes. Virginia is thinking about taking its portion and charging it directly to the data centers that take service in Virginia.

But what about all the costs for data center transmission lines that are assigned to other states? The other states cannot charge them to Virginia's data centers, they can only charge them to the customers who take service in their own state. We're all still stuck with the cost of transmission extension cords that serve Virginia's data centers.

How can this change? It can only change at the federal level where PJM's transmission cost allocation formula is approved. That's FERC's jurisdiction. When consumers and consumer advocates asked FERC to make PJM change its cost allocation formula to make the state with the data centers needing new transmission responsible for their entire cost, they were rejected 2-1. Only when the entire cost of the transmission gets allocated to the state where the data centers take service can it be properly allocated to the actual users of these new extension cords through the very process Virginia is currently proposing. Virginia's proposal only passes Virginia's share of the transmission line costs to Virginia's data centers. The data centers that need the new transmission are not taking service in those other states and therefore the other states have no choice but to allocate the costs of new transmission service for Virginia's data centers to their own consumers.

Perhaps Virginia should first be asking FERC to change PJM's cost allocation formula so that Virginia is responsible for the entire cost of their transmission needs. Instead, Virginia is happy to be a parasite and let other state electric consumers pay the cost of serving their data centers.

When consumers and consumer advocates questioned PJM's cost allocations for its Window 3 projects last year, the majority of the Commissioners were of the opinion that since PJM's cost allocations are already set and the cost allocations for Window 3 followed that cost allocation scheme, the only thing the Commission could do was approve them. However, Commissioner Christie had a different opinion (although he legally had to concur). He thought that the Commission should take up the issue of who pays for state public policies that cause new transmission, such as building data centers, or closing fossil fuel power plants.

While this matter (and the November 2023 RTEP Order) both arise in PJM, the issue of the proper regional cost allocation for public policy-driven transmission projects is not confined to PJM, but is applicable across all of the nation’s multi-state RTOs. Since RTOs are regulated by this Commission, I believe that the time has come for this Commission to take the lead in its convening role to initiate a proceeding, such as a Notice of Inquiry, a series of technical conferences, or by initiating an FPA section 206 proceeding outside this docket, posing such important questions, among others, as: What is the proper definition of a public policy transmission project? Does the definition of public policy transmission project need to be changed for purposes of regional cost allocation? How should public policy transmission projects be cost-allocated in a multi-state RTO? In my view the states themselves need to be at the forefront of deciding these questions, as it is their own state policies that are largely making these questions unavoidable, as these two recent PJM RTEP cases graphically illustrate.

Meanwhile, Virginia will be taking comments after it holds its technical conference on December 16. You don't need to live in Virginia to submit a comment asking them to raise the issue at FERC so that ALL its data center extension cord costs are allocated to Virginia, who can then re-allocate them to the data centers. Nothing is ever going to change unless the other states speak up.

Click here for more information about Virginia's technical conference, Case No. PUR-2024-00144.

RSS Feed

RSS Feed