ACEG is nothing but a transmission industry front group that writes numerous spin studies to promote their product, whether we need it or not. The studies aren't compiled for regular Americans like you... they are put together and promoted endlessly on Capitol Hill to convince your elected representatives that they should enact enabling legislation for more transmission, and more profits for their members. If you wrap your propaganda in a "study" it's supposed to have more clout. Another old propaganda trick!

So, here's the latest Spin Study being spun by CBTFWWP, and it includes a list of transmission projects we need right now to usher in a clean energy future.

The Spin Study names 36 transmission projects that it claims are "Ready to Go." It defines "Ready to Go" like this:

The determination of whether a project is ready-to-go relied on two criteria: 1) whether the project is at or near the finish line on the various federal and state permits they may need; and 2) whether the project is actively pursuing the cost recovery, allocation, and/ or subscriptions required for the developer to proceed. Inherently some judgment is re- quired. Based on these criteria we excluded over ten significant projects that are in earlier stages of development and not yet far enough along to be considered ready-to-go.

Clean Line – Originally proposed in 2009 by Clean Line Energy Partners to deliver renew- able energy from the Oklahoma Panhandle to Southeast markets, the Oklahoma portion of this DC merchant line was purchased and is now being developed by NextEra Energy.

The spin gets even thicker on the projects that have failed since the first Spin Study.

Lake Erie Connector – DC line under Lake Erie, connecting Ontario with PJM, the grid operator in the Mid-Atlantic and Great Lakes region. The project had been under devel- opment for approximately 10 years, but ITC Holdings, which purchased the rights to the project in 2014, placed the project on hold citing economic conditions.

“ITC made the decision to suspend the project after determining there is not a viable path to achieve successful negotiations and other requirements within the required project schedule. External conditions – including rising inflation, interest rates, and fluctuations in the U.S.-to-Canadian foreign exchange rate – would prevent the company from coming to a customer agreement that would sufficiently capture both the benefits and the costs of the project,” an ITC spokesperson said in a prepared media statement. “As a result, the company believes suspending the project is in the best interest of stakeholders.”

Speaking of word salad, the spinners claim that new transmission will be the key to reaching clean energy utopia.

Not only has investment in regional transmission lines been decreasing, but at the same time the need for regional transmission has been increasing due to a variety of factors. These include increasing demand growth, electrification of transportation and other sectors, higher natural gas prices due to European demand, a changing resource mix due to the economics of new renewable generation, increased customer demand for renewable resources, significant utility commitments for renewable energy expansion and decarbonization, and new public policies from local, state, and federal governments promoting carbon-free generation. The aggregation of these trends suggests a shift in the generation mix and significant load growth over the next few decades, both of which will require new transmission capacity.

Transmission capacity is also critical in helping shift national economic policy toward an increased focus on onshoring manufacturing to develop domestic supply chains. De- velopment of new domestic manufacturing along with growth in data centers, partially driven by AI, represents the potential for significant economic growth and job growth for the US.

These new manufacturing facilities, along with new data centers, often require additional transmission to ensure the grid has the capacity to reliably interconnect significant new industrial loads. However, delays are already beginning to occur. Interconnection requests for data centers have dropped across the country and in Northern Virginia – a national hub for data centers – there is a scramble to meet the soaring power demand as current grid capacity is limited.

Some experts estimate that fully electrifying the US’s industrial load could more than double current US power demand. The current issues are arising even before manufacturing for microchips and additional electric vehicle production and battery manufacturing facilities fully ramp up, along with hydrogen production facilities. If sufficient transmission capacity is not available, these investments could be significantly delayed or even canceled.

The Spin Study has been produced for one purpose only... to pander to Congress to pass even more enabling legislation for transmission. Its recommendations to do just that are at the end of this "study." It recommends special tax credits for new transmission, federal transmission permitting and siting, federal eminent domain, and wider cost allocation.

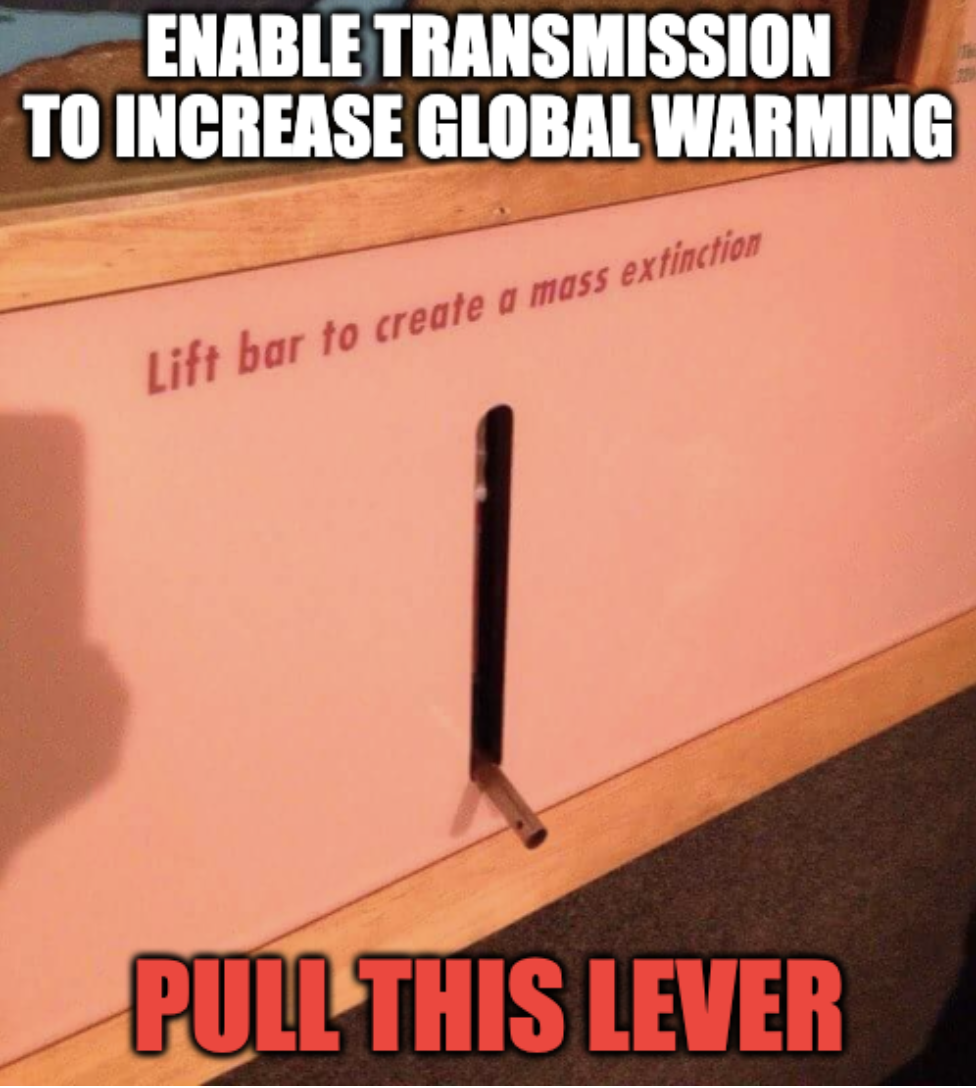

There are also additional policy levers that Congress and FERC could pull to help facilitate faster and more effective buildout of new transmission. Americans for a Clean Energy Grid’s Legislative Principles outlines a number of these potential approaches.

Enabling new transmission with legislation is the fast track to increasing carbon emissions.

RSS Feed

RSS Feed