[C]ontinued growth of the wind energy industry depends on the expansion of the U.S. electric transmission grid. The United States has some of the best renewable resources in the world, but they are predominantly located far from large population centers. The challenge lies in connecting these rich resources to communities that need the power—a challenge Clean Line Energy is working to address.

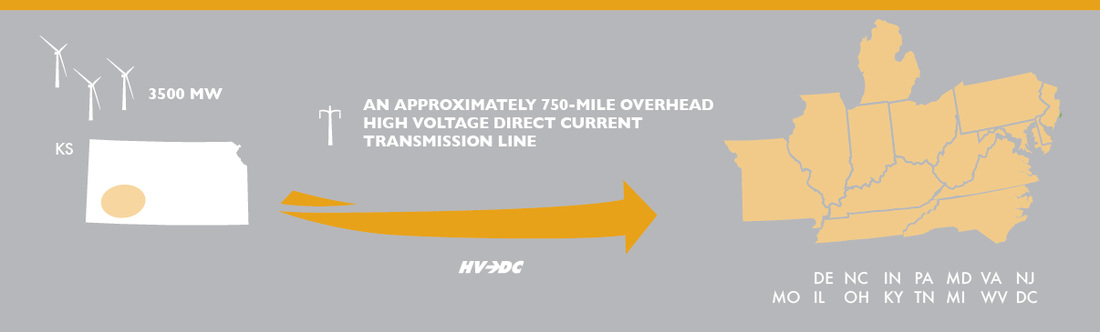

Here's a map of the "resource area" for Clean Line's Grain Belt Express project.

Clean Line says no wind will develop there without a "Clean" Line to transmit it to population centers.

But it did.

Last Friday, a huge press conference was held to announce that the Cimarron Bend wind farm was fully subscribed and under construction in Clark County Kansas, just south of Ford County.

On its website, the developer initially proposed that Cimarron Bend is a "candidate" in GBE's resource area that may "connect" with GBE.

What transmission line does the project connect with?

Cimarron Bend Wind Project is expected to interconnect to the new ITC 345kV Clark County Substation located just a few miles north of the Cimarron Bend project boundary. The project is also a candidate to tie into a proposed Clean Line Energy DC transmission line that would export Kansas wind energy to the east.

Customers of Cimarron Bend are the Kansas City, Kansas, Board of Public Works (200 MW) and Google (200 MW), who both signed bundled power purchase agreements for Cimarron Bend's 400 MW capacity. Cimarron Bend didn't need GBE in order to be developed at all. There's plenty of existing transmission to move the power to Kansas City and wherever Google plans to use it, and the project is expected to come online in early 2017.

Kansas wind energy from the GBE resource area CAN be developed without GBE after all. And more importantly, it will be consumed by Kansans. Grain Belt Express proposes to export 4,000 MW of wind energy from the resource area out-of-state, with none available for use by Kansans, who also like lower bills and cleaner energy.

But more importantly, he said the price BPU is paying over the course of its 20-year contract will make wind energy from Cimarron Bend nearly the cheapest electricity that BPU buys, almost equal to the price of energy from its own coal-fired power plant.

"When they told me the price, I just about fell out of my chair," Gray said. "I didn't realize that in this fairly short time period that the economics of obtaining wind energy is really showing itself. ... It's going to be one of the lowest-cost energy resources that we have in our generation mix."

But not so good for GBE, whose resource area is going to be further developed for use by Kansans while the company remains stuck in permit hell. The world doesn't wait for Clean Line, and every day that passes lessens the company's relevance.

So, why did Cimarron Bend initially think its project was a candidate for GBE, when plenty of opportunity to sell its energy to Kansans existed? Because

The power produced from Cimarron Bend Wind Project is being marketed to Kansas electric utility companies, other utility companies located within the Southwest Power Pool regional transmission area, and also to customers in states further east.

GBE is nothing but a profit-making enterprise designed to profit off wind farms, who maximize their own profits by selling into higher priced markets. GBE is not "necessary" to develop wind resources in Kansas, or anywhere else. It's only necessary to increase wind energy profits for a select group of investors.

And utilities in those "states further east" aren't signing up to purchase expensive, imported wind power. At a Transmission Summit earlier this month, Southern Company's Vice President of Energy Policy had this to say:

Edelston said the planning process isn’t the reason for the lack of interregional transmission projects.

“It’s whether there’s somebody who is benefiting from that line who’s willing to pay for it. … There are very few interregional lines that are going to be economic when you look at the alternatives available to the purchasing region — the region that would be receiving the renewable energy. They often have local alternatives or closer alternatives that don’t require transmission fixes, and these long distance interregional lines can be very, very expensive — and as we’re seeing with the Clean Line Energy Partners lines up in Illinois — very, very difficult to build.”

“In our case, with the price of solar having come down so far, it turns out to be much more economic to build utility-scale solar within our service area than it is to build long-distance transmission to access wind in the Midwest. And I think that’s true for a lot of East Coast load centers. You also have the opportunity these days to buy RECs — or renewable energy certificates — to meet any renewable portfolio standards that you have.”

Just one more nail in Clean Line's coffin.

RSS Feed

RSS Feed