Start here. Canary Media is a politically biased "news" website. Everything they print is to support "the clean energy transition." If Canary Media is publishing "a new survey" by the Conservative Energy Network, you know there's propaganda afoot. What's Conservative Energy Network? It's not a network of conservative energy ideas, that's for sure. Google tells me it's a network of left-leaning philanthropic organizations and the energy industry and fully funded by left-leaning dark money groups. Is this really about whether people want new transmission lines?

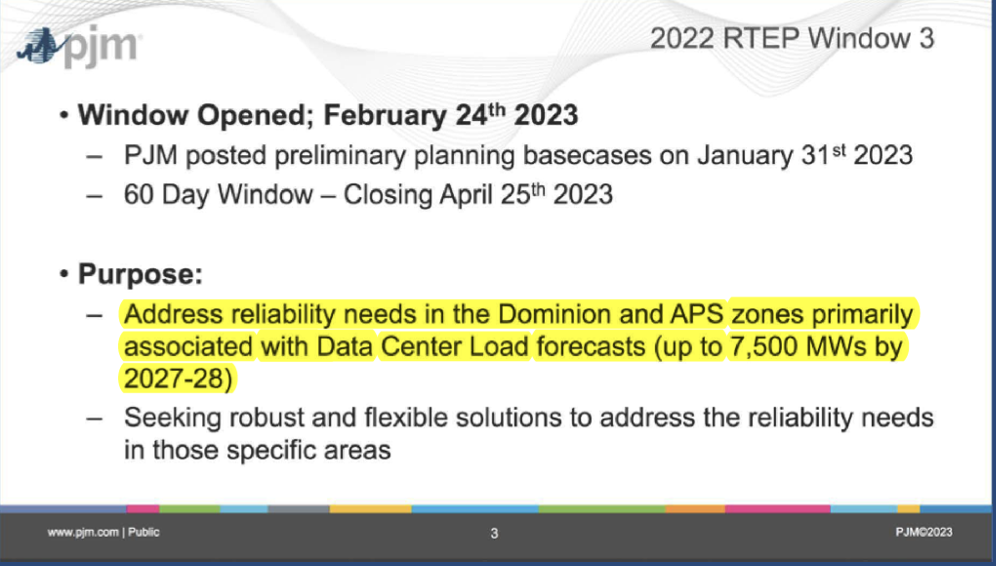

Not really. There was a push over the last four years to spend gobs of money on "the energy transition" that would change our energy supply from fossil fuels to 100% wind and solar. LOL, dear readers. That just can't happen. But the fantasy story said that if we only build tons and tons of new electric transmission everywhere that we can ship intermittent wind and solar around to keep the lights on. But any hope these folks had was dashed by AI's skyrocketing increase in power demand. Keep that fact handy... AI killed wind and solar.

Apparently these left-leaning organizations and an energy industry left with half-finished project ideas do not yet want to admit they're dead. They're still spending money spewing out propaganda like this "new survey" that tells us that Americans are overwhelmingly in favor of new transmission if they are fed a strict diet of propaganda, and as long as none of that nasty new transmission comes anywhere near them!

This "new survey" isn't really a survey at all. It's an exercise in message development as the basis for a propaganda campaign to convince the masses that we need new transmission for reasons that are not true. This group wants to build transmission lines for wind and solar "farms". It doesn't want to build transmission because it will lower costs, prevent blackouts, or do some rah rah rah on "American" energy. But it is laying the groundwork to convince people they need new transmission using these meaningless and untrue messages. Propaganda!

What is propaganda? It's the dissemination of a message, or series of messages, designed to implant an idea in everyone's mind or change their thinking about something. The messages are very simple and everyone can understand them. The messages are repeated over and over and over and over until they somehow transform into common knowledge accepted as fact, although there is nothing to back it up. Here's the Conservative Energy Network's propaganda messages about transmission lines:

Propaganda message #1

Positive Impacts for Americans: Upgrading the grid is worth it if it creates good-paying jobs for American workers, boosts economic development in communities, and uses American-made materials – even if it costs a little more – because it keeps our country strong.

Propaganda Message #2

American Energy: Upgrading our electricity transmission grid will allow us to produce more energy here in our own state, reducing dependence on foreign countries. It is a key step toward future energy independence.

Propaganda Message #3

Lower Costs: A modern electricity transmission grid helps open the door for more competition and innovation in energy, giving consumers more options with lower prices and better service.

You're not getting anything from new transmission... except the bill!

Propaganda message #4

Prevent Blackouts: A stronger, smarter electricity transmission grid protects us from blackouts, cyberattacks, and natural disasters – keeping the lights on when it matters most.

And there's my favorite nails-on-a-chalkboard phrase, "when it matters most" aka "where it's needed most." What the heck? When doesn't it matter if you have electricity at your house? When's a good time to have a blackout? Never, that's when. And who "needs" electricity more than you? Are you willing to shut off your power so that AI can make some keyboard bottom feeder a picture of a cat roller skating in outer space?

Now let's take a look at the questions they asked to recognize how the questions shaped the respondent's answer.

Do you support or oppose making investments in America’s “electricity transmission grid” to improve reliability, reduce costs, unlock economic growth in communities, and meet future power needs?

See how they put the answer they wanted in the question and the respondent had no choice to disagree with the information in the question? It's not really about asking a question anyhow, it's about pushing propaganda in your head pretending to do a "survey."

Thinking about the “electricity transmission grid”, the network of large, tall, steel towers and high-voltage power lines that carry electricity across the state and region … Do you support or oppose making investments in America’s “electricity transmission grid” to improve reliability, reduce costs, unlock economic growth in communities, and meet future power needs?

What do you get if you oppose? The respondent isn't given a choice to disagree with the question... it's just a propaganda vehicle.

Which energy policy goals are most important to you? Select up to two options.

1. Keeping electricity costs affordable for families.

2. Ensuring the electric grid is reliable and blackout-proof.

3. Protecting the rights of local communities and property owners when building energy projects.

4. Expanding American energy independence.

5. Establishing American energy dominance.

6. Utilizing clean energy.

You might be surprised to learn that bogus "goals" about energy independence and dominance scored higher than protecting the rights of local communities and landowners. That's because at this point in the "survey" all the transmission was envisioned by the respondents to be on someone else's property.

If a new high-voltage (long-distance and high powered) electricity line was proposed in your area, would you generally support or oppose it?

Should landowners be allowed to block construction of transmission lines on their property, or should projects be built over landowner objections if fair compensation is offered?

Oh, now this stuff is in the respondent's neighborhood? How quickly the bloom comes off the propaganda rose! More than 50% thought landowners ought to be able to block construction (because all of a sudden this is personal)!

These respondents also had a lot of other crazy thoughts about who should select the kind of energy they use, and who should pay for it. Check out the whole survey to see how much they don't know about electricity and their bills.

So, here's the bottom line. This survey is useless. All those push poll questions are rejected when the truth is finally told. No matter where the new transmission is, the people impacted by it will revolt and step up to crush it. There's transmission opposition afoot all over the country because a lot of the transmission projects that were planned over the past 4 years have now advanced to the public notice stage. NOBODY wants transmission that impacts them. This survey doesn't matter in the least. It has no impact whatsoever on transmission opposition. It doesn't even influence those unaffected to support transmission in real time. As you gleaned reading the "survey," the respondents are a pretty dumb bunch. These people aren't going to go out of their way to send letters, or go to public hearings, to support new transmission. They're not going to do anything at all. Well, unless some eager transmission lover pays them to show up somewhere and say dumb things like the propaganda in this survey. Or maybe they'll put their name on a form letter and let the transmission lover send it to a utility commission. Or sign a petition.

But does stuff like that really move the needle? How much paid advocacy does a state utility commission need to approve a transmission project despite overwhelming opposition? I suppose we'll be finding out.

Remember, utility friends, you can't charge that crap to ratepayers.

RSS Feed

RSS Feed